|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

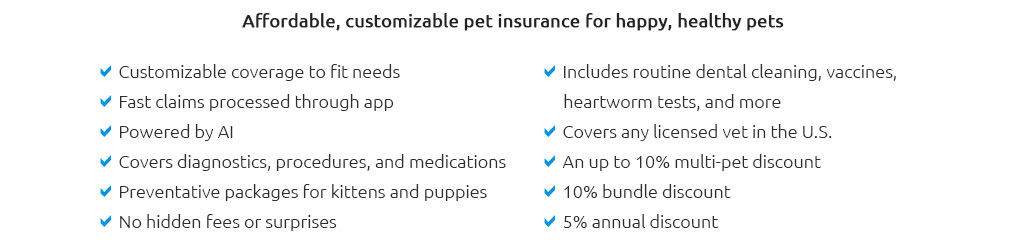

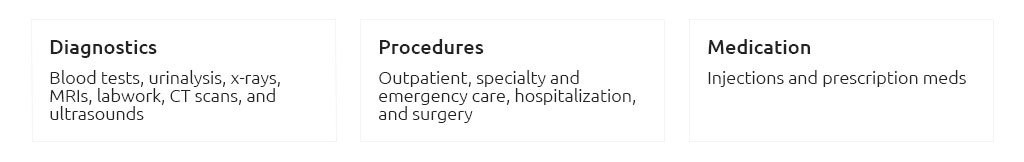

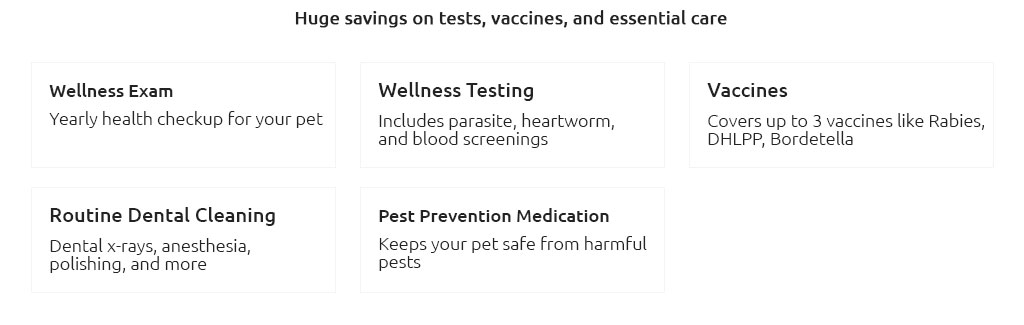

Understanding Pet Insurance in California: Making Informed DecisionsIn recent years, the demand for pet insurance in California has seen a notable surge, driven by a growing awareness of the benefits it offers to pet owners. As Californians increasingly consider their pets to be integral members of the family, the importance of safeguarding their health becomes paramount. But what exactly is pet insurance, and why has it become such a crucial consideration for pet owners in the Golden State? Pet insurance is essentially a health coverage policy for pets, typically dogs and cats, designed to help mitigate the costs of veterinary care. In California, a state known for its progressive stance on animal welfare, pet insurance policies are especially popular, offering a financial safety net that can ease the burden of unexpected veterinary expenses. The concept is simple yet profound: pay a monthly premium to cover potential health issues, which can range from minor ailments to serious conditions requiring extensive treatment. One of the most compelling reasons Californians opt for pet insurance is the state's high cost of living, which extends to veterinary care. Clinics across the state offer top-notch services, but these come at a price. Without insurance, a sudden illness or accident can lead to veterinary bills that are overwhelming. For instance, an emergency surgery can cost thousands of dollars, a financial strain that can be alleviated with a comprehensive insurance plan. It's here that pet insurance reveals its value, providing peace of mind that pet owners can afford critical care without hesitation. But choosing the right pet insurance involves careful consideration. Coverage options vary widely, and it’s important for pet owners to understand what is included in a policy. Most plans cover accidents and illnesses, while others offer wellness coverage for routine care such as vaccinations, check-ups, and dental cleanings. Some plans even cover hereditary and congenital conditions, which is a significant factor for owners of purebred animals that are prone to specific health issues. However, not all plans are created equal, and it’s vital to read the fine print to understand exclusions and limitations. Another crucial aspect is the choice of provider. In California, numerous companies offer pet insurance, each with its own set of benefits, costs, and customer service reputations. It's advisable to compare multiple providers, considering factors such as monthly premiums, deductibles, reimbursement levels, and customer reviews. Websites that offer comparative tools can be incredibly useful for this purpose, allowing pet owners to evaluate and select a plan that aligns with their budget and needs. While the upfront cost of pet insurance might seem like an unnecessary expense to some, especially if their pet is currently healthy, it’s a strategic investment that can save money in the long run. Moreover, it alleviates the emotional stress associated with making difficult decisions based on financial constraints during a pet's medical emergency. The emotional bond shared between Californians and their pets is profound, and ensuring their well-being is a reflection of that relationship. Additionally, pet insurance contributes to a broader societal benefit by promoting responsible pet ownership. By providing a financial cushion, it encourages more frequent veterinary visits, which can lead to early detection of health issues and better overall pet health. This proactive approach can ultimately extend the lifespan of pets, allowing owners to enjoy their companionship for years to come. In conclusion, as the landscape of pet ownership continues to evolve in California, so too does the necessity for pet insurance. It's a decision that requires thoughtful consideration of various factors, but ultimately offers invaluable peace of mind. For Californians, investing in pet insurance is more than just a financial decision; it's a commitment to ensuring the health and happiness of their furry family members. https://www.sfchronicle.com/personal-finance/article/california-pet-insurance-law-2025-20041131.php

A new California law requires pet insurers to clearly disclose coverage, costs and other details, and to distinguish wellness programs from ... https://www.embracepetinsurance.com/

Pet insurance from Embrace saves you up to 90% back on vet bills from unexpected illness and medical expenses. From dog and cat insurance to wellness ... https://www.costco.com/pet-insurance.html

As a Costco Member, you are eligible to receive an exclusive 15% pet insurance discount* through Figo Pet Insurance. The 15% discount reflects the percentage of ...

|